Regulatory Regime

| About the Regime | Exemptions | Regulatory Compliance for Foreign Dealers | Our Role in AML/CFT/CPF |

About the Regime

The regime covers regulated dealers.

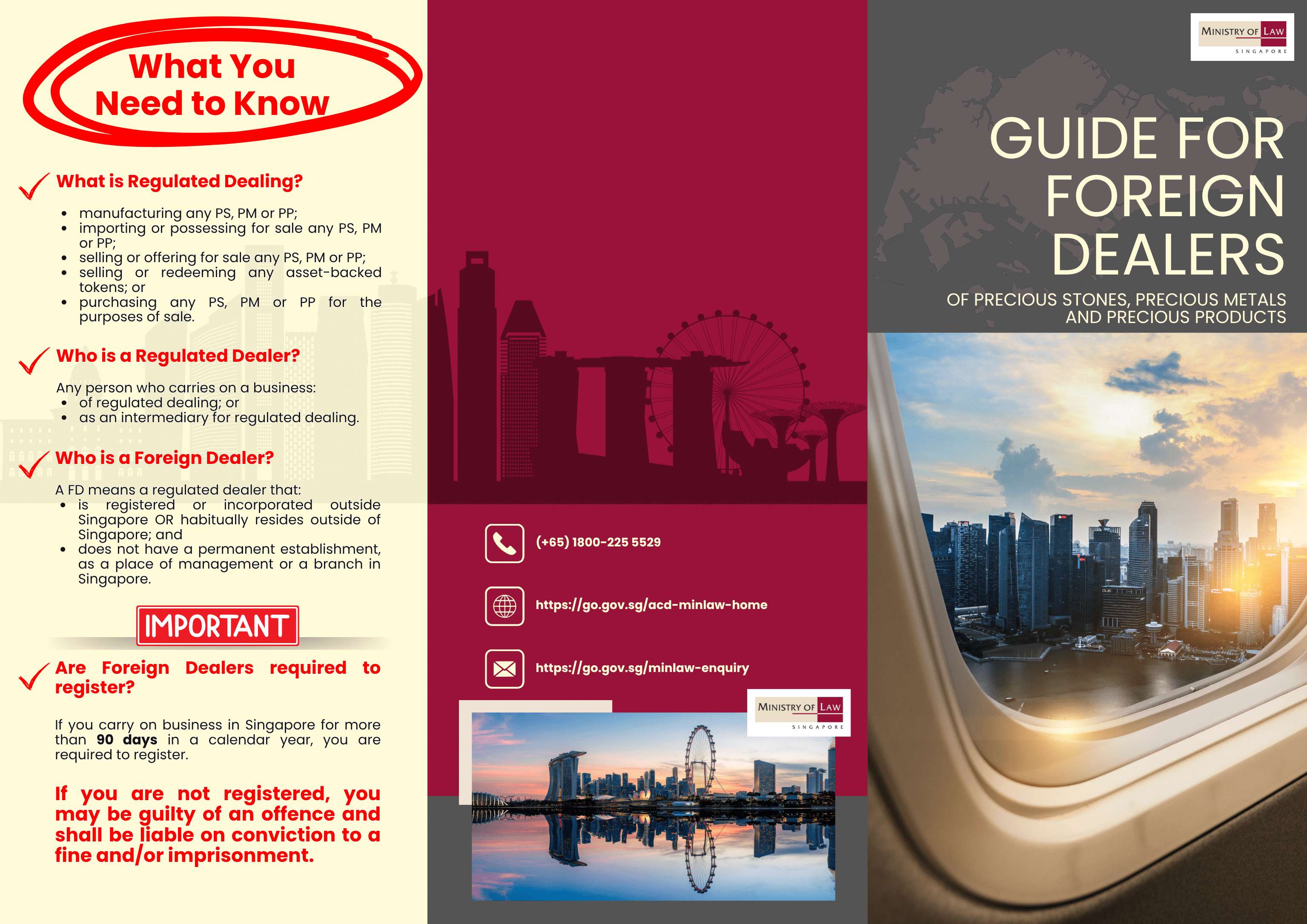

A “regulated dealer” is any person who carries on a business:

(a) of regulated dealing; or

(b) as an intermediary for regulated dealing.

“Regulated dealing” means:

(a) selling, offering for sale, purchasing for the purpose of resale, importing for sale, possessing for sale, or manufacturing any “precious stone”, “precious metal” or “precious product”; or

(b) selling or redeeming any “asset-backed token”.

Examples

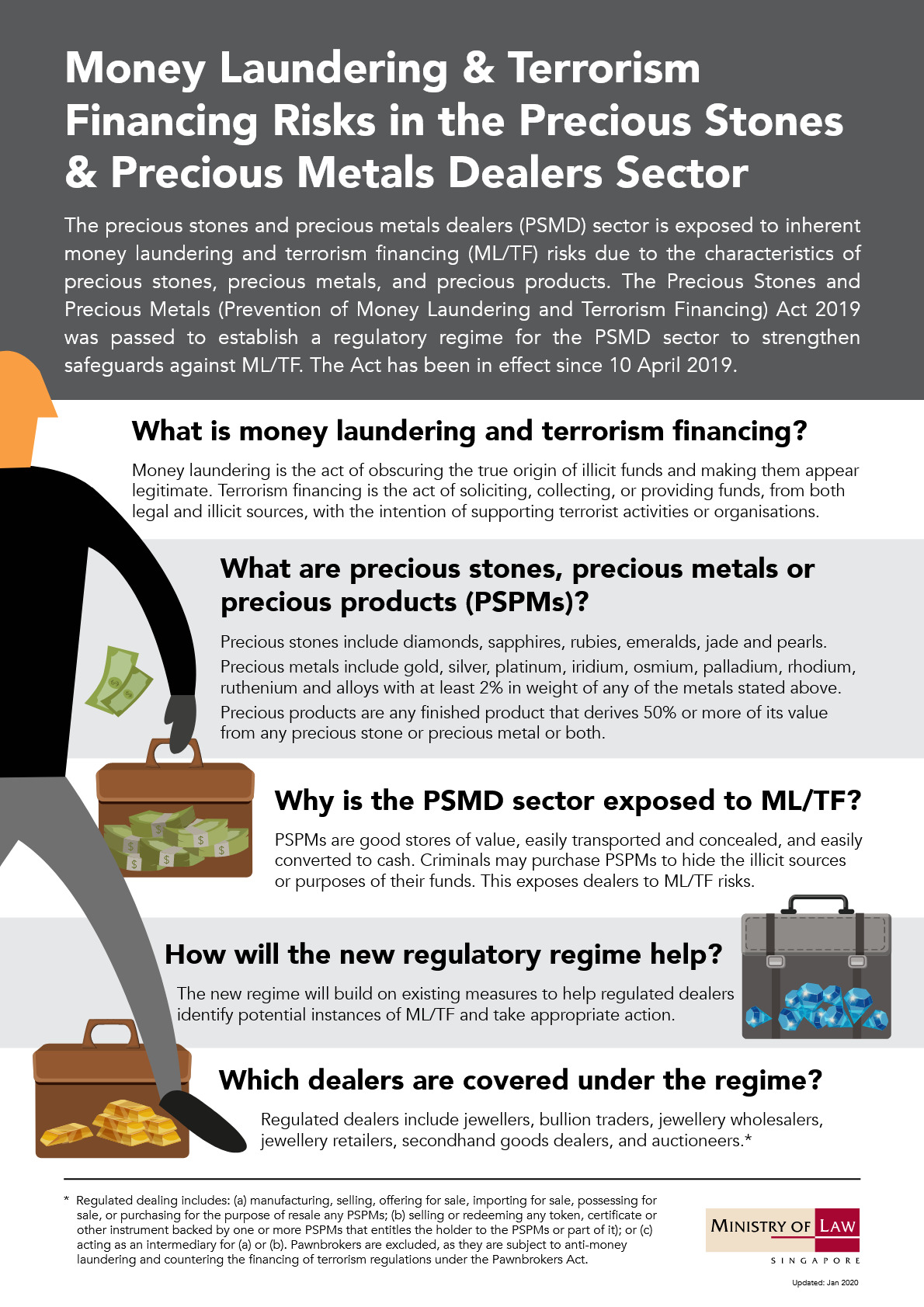

Regulated dealers include, but are not limited to, jewellers, bullion traders, jewellery wholesalers, jewellery retailers and secondhand goods dealers. The regime also applies to regulated dealers who are based overseas but carry on a business of regulated dealing in Singapore.

Intermediaries for regulated dealing who are covered under the regime include, but are not limited to, auction houses and trading platforms.

Importantly, the regime does not intend to cover individuals who make one-off purchases and subsequently decide to sell their items to a secondhand goods dealer. Further, pawnbrokers are not regulated dealers as they are already subject to AML/CFT/CPF measures under the Pawnbrokers Act 2015.

What does the regime cover?

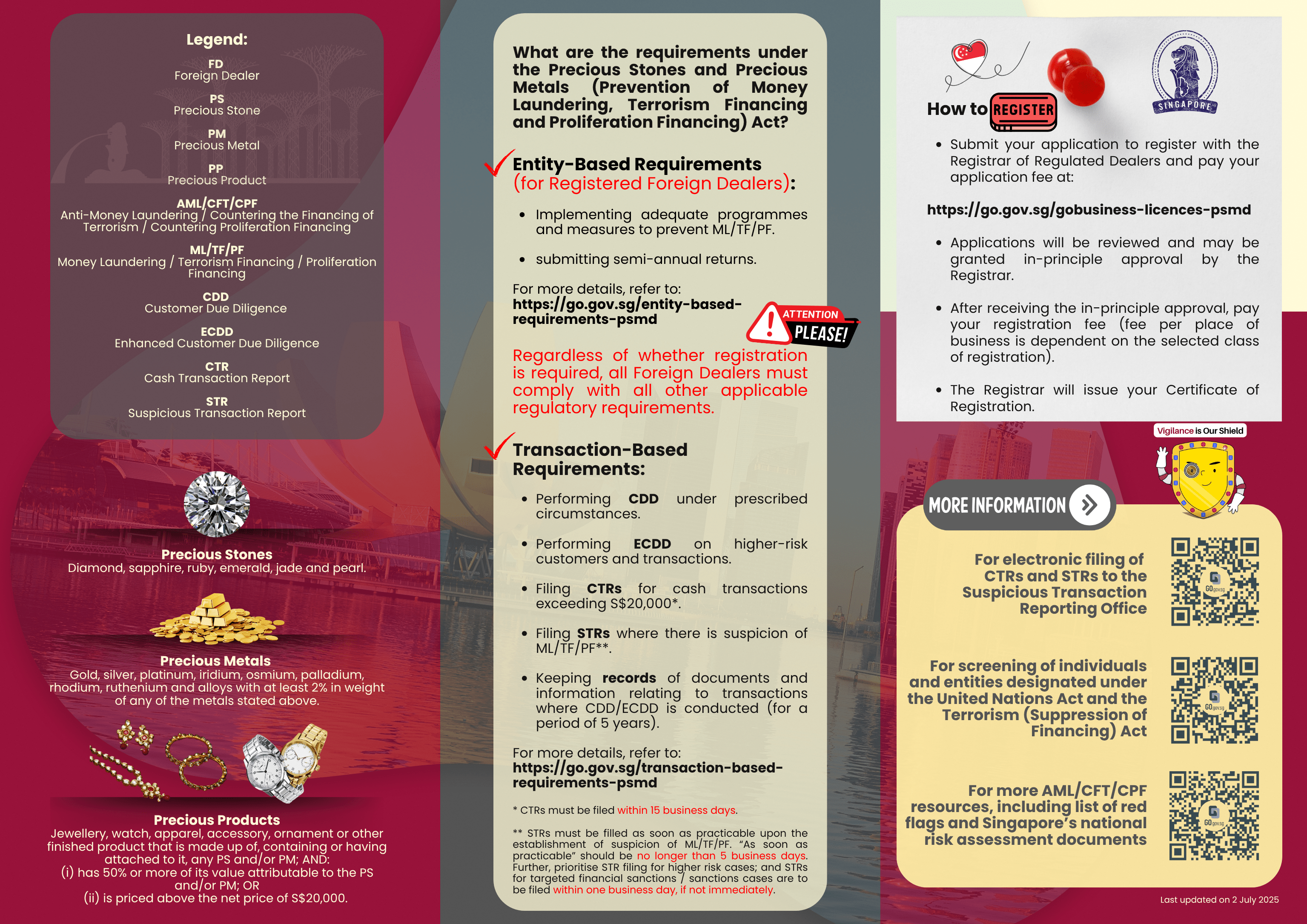

“Precious stones” (natural or otherwise) include diamonds, sapphires, rubies, emeralds, jade (including nephrite and jadeite), and pearls.

“Precious metals” include gold, silver, platinum, iridium, osmium, palladium, rhodium, ruthenium, and alloys with at least 2% in weight of any of the metals stated above.

“Precious products” include, but are not limited to, any jewellery, watch, apparel, accessory, ornament or other finished product that:

(a) derives 50% or more of its value from any precious stone and/or precious metal making up, contained in, or attached to that product; or

(b) is above the net price of S$20,000.

An “asset-backed token” is any token, certificate or instrument:

(i) backed by one or more “precious stone”, “precious metal” or “precious product”; and

(ii) that entitles the holder to the “precious stone”, “precious metal” or “precious product” or part of it (e.g. certificates or tokens).

Asset-backed tokens do not include securities or derivatives contracts within the meanings of the Securities and Futures Act (Cap. 289), and commodity contracts within the meaning of the Commodity Trading Act (Cap. 48A). Securities contracts, derivatives contracts and commodity contracts are not covered under the regime.

Please click here to find out more about the roles and expectations of a regulated dealer.

Exemptions

The following persons are exempted from registration under the Precious Stones and Precious Metals (Prevention of Money Laundering, Terrorism Financing and Proliferation Financing) Act 2019 (“PSPM Act”):

- A pawnbroker as defined under Section 3 of the Pawnbrokers Act 2015.

- Any person licensed, approved, registered or regulated by the Monetary Authority of Singapore under any written law.

- A “foreign dealer” which only carries on business in Singapore for not more than a total of 90 days in a year.

Foreign dealers should refer below to find out more about their compliance requirements under the PSPM Act.

Regulatory Compliance for Foreign Dealers

Brochure: Guide for Foreign Dealers of Precious Stones, Precious Metals and Precious Products

Who are foreign dealers?

Foreign dealer means a regulated dealer that -

(a) is -

(i) registered or incorporated outside Singapore, in the case of a body corporate or unincorporate; or

(ii) habitually resident outside Singapore, in the case of an individual; and

(b) does not have a permanent establishment, a place of management or a branch in Singapore at which the regulated dealer carries on the business of regulated dealing or business as an intermediary for regulated dealing.

What are the regulatory compliance requirements for foreign dealers?

Foreign dealers are subject to all other transaction-based requirements under the PSPM Act, which include conducting customer due diligence (“CDD”), keeping records, and filing of Cash Transaction Reports (“CTR”) and Suspicious Transaction Reports (“STR”).

Do foreign dealers need to register?

A foreign dealer carrying on a business of regulated dealing, or business as an intermediary for regulated dealing, in Singapore on a transitory basis is exempt from registration. Transitory basis means the foreign dealer carries on business in Singapore for not more than a total of 90 days in a year.

Any person who acts or holds out to be a regulated dealer without being registered or exempted, may face criminal penalties of up to S$75,000 in fine and/or up to 3 years’ imprisonment.

Learn more about regime, registration and transaction-based requirements.

A foreign dealer must notify the Ministry of Manpower of your intention to work in an exempted activity after entering Singapore, and before starting the activity. Click here for more information.

Must-Know for Foreign Dealers: Watch the video to find out more about the regulatory requirements for foreign dealers.

Our Role in AML/CFT/CPF

Singapore is a member of the Financial Action Task Force (“FATF”), an inter-governmental body that sets international standards aimed to prevent money laundering, terrorism financing and proliferation financing (“ML/TF/PF”), and the harm these illegal activities cause to society. There are currently more than 200 countries and jurisdictions committed to implementing anti-money laundering/countering the financing of terrorism/countering proliferation financing (“AML/CFT/CPF”) measures in accordance to the recommendations set by the FATF.

Designated non-financial businesses and professions (“DNFBP”) in Singapore, such as the precious stones and precious metals dealers (“PSMD”), have a role to play to ensure that Singapore is effective in implementing its AML/CFT/CPF policies through the PSMD sector. The regulatory requirements on the PSMD sector are set out in the PSPM Act and the Precious Stones and Precious Metals (Prevention of Money Laundering, Terrorism Financing and Proliferation Financing) Regulations 2019 (“PMLTFPF Regulations”). Regulated dealers should also refer to the Guidelines for Regulated Dealers (Published Date: 13 Feb 2026).

Please refer to the compliance requirements for more information on how to implement an effective AML/CFT/CPF framework for your business.